Dividend policy

Liechtensteinische Landesbank pursues an attractive, long-term-oriented dividend policy for the benefit of its shareholders. Furthermore, under the StepUp2020 strategy, the LLB Group is committed to safeguarding its financial security and stability. It intends to keep risk-bearing capital at a Tier 1 ratio of over 14 percent in accordance with Basel III. Against this backdrop, the payout ratio for shareholders should be 40 to 60 percent of Group net profit.

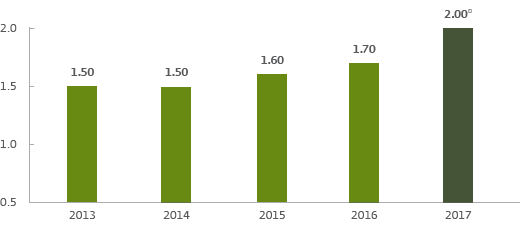

The Board of Directors will propose a dividend of CHF 2.00 per share (2016: CHF 1.70) at the 26th Ordinary General Meeting of Shareholders on 9 May 2018, representing an increase of 17.6 percent. Based on the share price as at the end of 2017, this corresponds to an attractive dividend yield of 4.0 percent. Total dividends to be paid out amount to CHF 57.8 million (2016: CHF 49.0 million). This represents a payout ratio of 51.9 percent for 2017 (2016: 47.2 %).

Dividend per share

2013 – 2017, in CHF

* Proposal of the Board of Directors to the General Meeting of Shareholders on 9 May 2018