LLB Group financial statement

In the 2017 financial year, the LLB Group earned a net profit of CHF 111.3 million (2016: CHF 103.9 million). The net profit therefore improved in comparison with the previous year by 7.1 percent or CHF 7.4 million.

In comparison with the 2016 financial year, operating income rose by 7.5 percent and operating expenses by 3.4 percent. The net profit attributable to the shareholders of Liechtensteinische Landesbank increased to CHF 105.7 million (2016: CHF 98.2 million). Earnings per share stood at CHF 3.66 (2016: CHF 3.40).

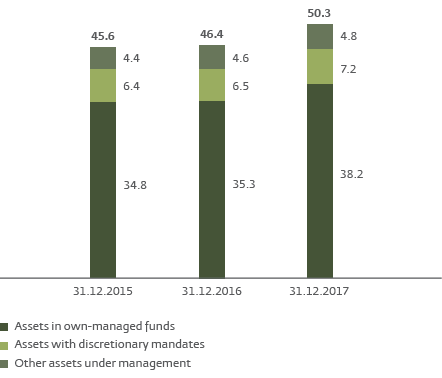

Assets under management

Thanks to gratifying net new money inflows and the performance of the financial markets, assets under management climbed to CHF 50.3 billion (31.12.2016: CHF 46.4 billion).

As a result of its intensive sales and marketing measures, the LLB Group initiated a trend turnaround with net new money inflows and achieved growth in all its strategic markets. In the 2017 financial year, net new money inflows totalled CHF 470 million (2016: minus CHF 65 million).

Assets under management (in CHF millions)

Outlook

The difficult economic environment, characterised by negative interest rates, volatile financial markets, increasing regulation and transformation in information technology, is continuing to challenge the banking industry.

Thanks to its focused business model, a diversified earnings structure, its clear StepUp2020 strategy, and the corresponding acquisitions, the LLB Group views the future with confidence. The integration of the acquisitions made will lead to both a contribution to income as well as integration costs in 2018. The LLB Group expects to attain a solid business result for the 2018 financial year.