Share price performance

The Swiss Performance Index (SPI) lost minus 1.4 percent on the previous year. Over the same time period, the price of the LLB share increased by 12.6 percent to CHF 40.35 as at 31 December 2016. The LLB share also significantly outperformed the banking sector: the SWX Banks Index ended the year 15.3 percent lower.

The LLB share held up very well despite historically low interest rates and global market uncertainties. The slight rise in interest rates at the end of the year and also, in particular, the diversified business model bode well for sustainable positive development. With its StepUp2020 strategy, the LLB Group is targeting profitable growth. Its annual results for 2016 underline its ability to generate good results even in a difficult environment.

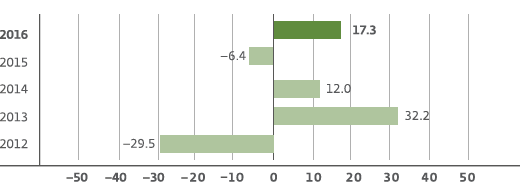

Total return on the LLB share

2012–2016, in percent

The total return on the LLB share stood at 17.3 percent (including re-invested dividends). The LLB share closed at CHF 40.35 on 31 December 2016.

| Download |

in CHF thousands |

31.12.2016 |

31.12.2015 |

||||

|---|---|---|---|---|---|---|

|

||||||

Total bearer shares issued |

30'800'000 |

30'800'000 |

||||

Number of shares eligible for dividend |

28'840'762 |

28'821'798 |

||||

Free float (number of shares) |

10'232'642 |

9'971'798 |

||||

Free float (in percent) |

33.2 |

32.4 |

||||

Year’s high (14 November 2016 / 9 January 2015) |

43.65 |

41.55 |

||||

Year’s low (18 January 2016 / 18 September 2015) |

33.35 |

34.00 |

||||

Year-end price |

40.35 |

35.85 |

||||

Total return LLB share (in percent) |

17.3 |

–6.8 |

||||

Performance SPI (in percent) |

–1.4 |

2.7 |

||||

Performance SWX Banking Index (in percent) |

–15.3 |

9.5 |

||||

Average trading volume (number of shares) |

8'433 |

6'908 |

||||

Market capitalization (in CHF billions) |

1.24 |

1.10 |

||||

Earnings per share attributable to the shareholders of LLB (in CHF) |

3.40 |

2.87 |

||||

Dividend per LLB share (in CHF) |

* 1.70 |

1.60 |

||||

Payout ratio (in percent) |

47.2 |

53.4 |

||||

Dividend yield at year-end price (in percent) |

4.2 |

4.5 |

||||

Return on equity attributable to the shareholders of LLB (in percent) |

5.9 |

5.0 |

||||

Eliglible capital per LLB share (in CHF) |

51.7 |

50.8 |

||||